Retirement is long, expensive, and often full of unknowns. You must understand this simple formula at all times during retirement. Read More

Retirement is long, expensive, and often full of unknowns. You must understand this simple formula at all times during retirement. Read More

In the short-term both politics and investing are messy. Let me tell you two basic principles that will allow you to have a better perspective of how to clean up that mess. Read More

Opportunity cost is what you lose by choosing one alternative over another. Money has opportunity cost and when it comes to retirement, it can be very expensive. Read More

A continuation on the importance of tax diversification. Totally tax free accounts offer great benefits dealing with the tax impact in retirement. Read More

A continuation on the importance of tax diversification. Tax Deferred accounts offer great benefits especially if your employer provides a match but be careful to properly plan the tax impact in retirement. Read More

When it comes to diversification, understanding the impact of taxes on your retirement is crucial to a successful and lasting plan. Read More

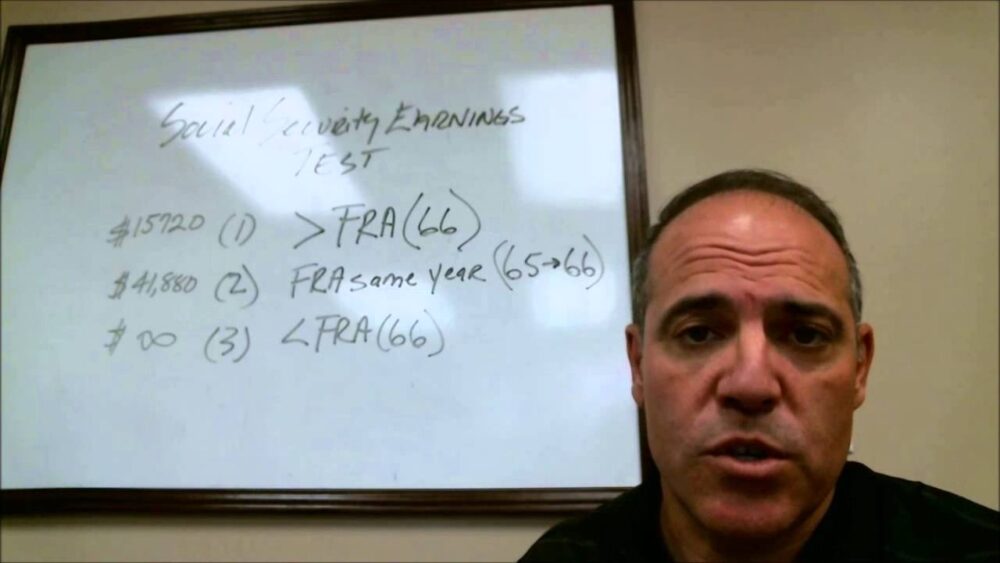

Can I work and collect Social Security at the same time? Well only if you follow these rules. Read More

You and your husband prepared to retire together then the unfortunate happens. Here are some points to be prepared about if your husband predeceases you. Read More

If you are retired you still run the risk of being audited by the IRS. Here are 4 common things that can raise a red flag. Be careful and let us help you with your tax preparation. Read More

Check out a recent letter received by Richard E. Reyes, CFP from a couple asking for help. Richard provides a detailed description of his clients. Read More