With interest rates starting to creep up, is it time to refinance your mortgage? Here is a few things to consider before you take that step. Read More

With interest rates starting to creep up, is it time to refinance your mortgage? Here is a few things to consider before you take that step. Read More

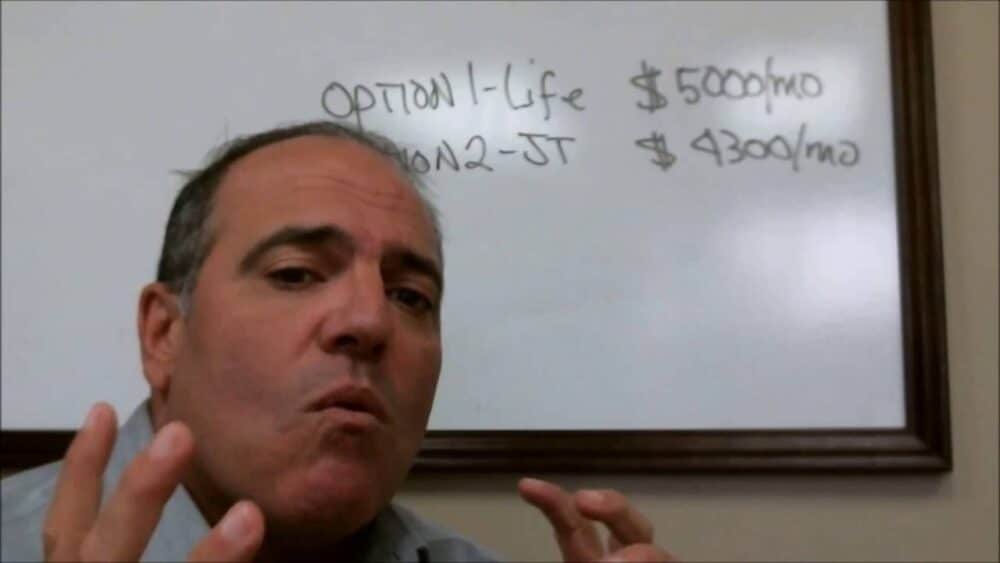

Do I need life insurance in retirement? Planning with life insurance can provide you with some safe and great benefits. Let’s review how life insurance can provide you with more pension income. Read More

Anyone may arrange their affairs that their taxes shall be as low as possible; you are not bound to choose that pattern which best pays the Treasury. There is no patriotic duty to increase one’s taxes. Read More

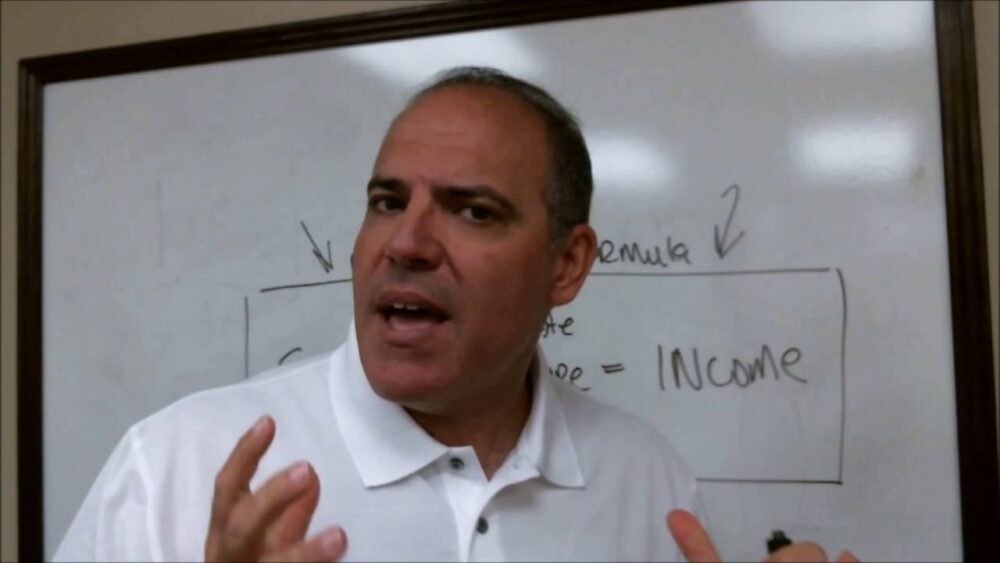

Retirement is long, expensive, and often full of unknowns. You must understand this simple formula at all times during retirement. Read More

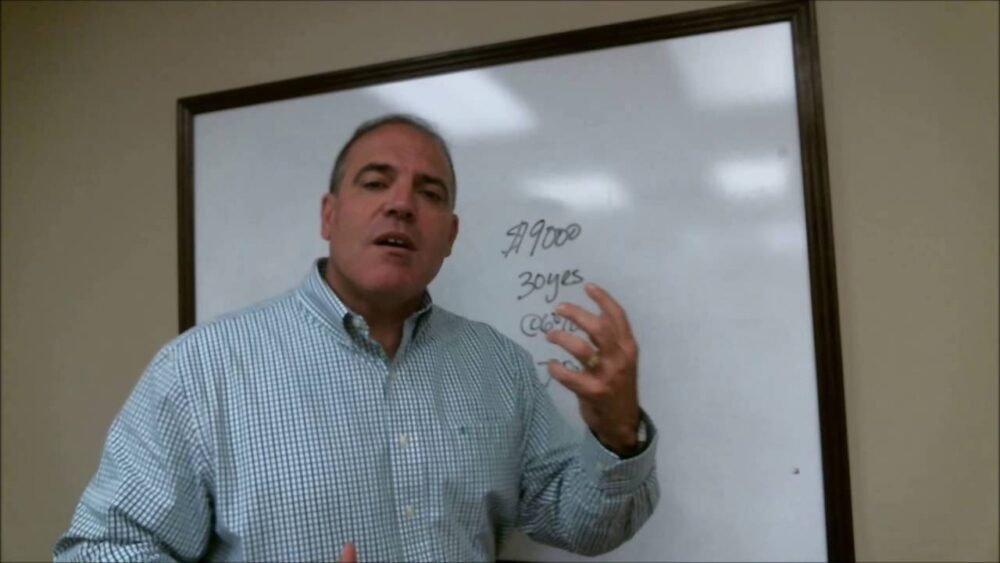

A continuation on the importance of tax diversification. Totally tax free accounts offer great benefits dealing with the tax impact in retirement. Read More

A continuation on the importance of tax diversification. Tax Deferred accounts offer great benefits especially if your employer provides a match but be careful to properly plan the tax impact in retirement. Read More

When it comes to diversification, understanding the impact of taxes on your retirement is crucial to a successful and lasting plan. Read More

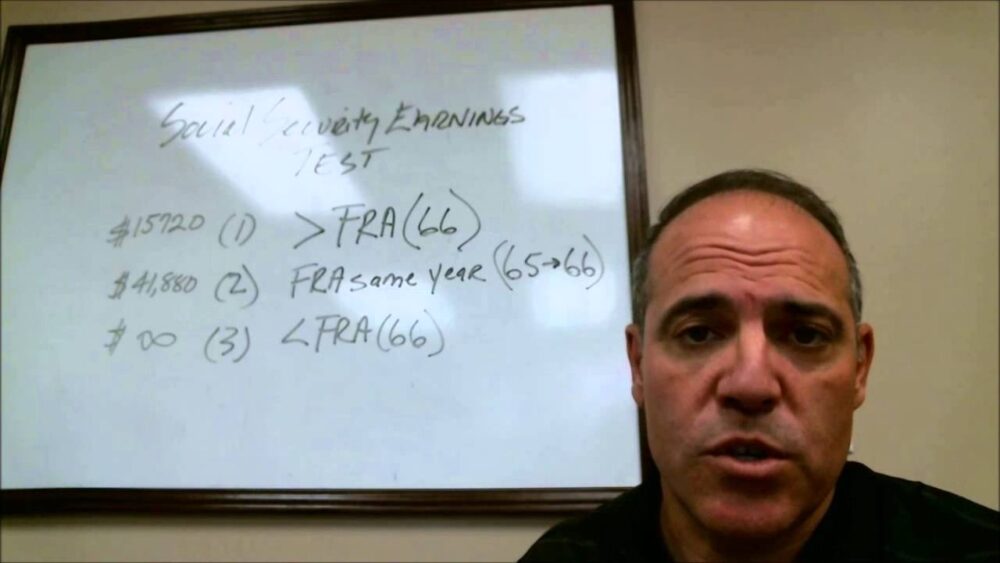

Can I work and collect Social Security at the same time? Well only if you follow these rules. Read More

by Richard E. Reyes, CFP