This is the time of year everyone’s looking at how their investments performed. Don’t make the HUGE MISTAKE most other people make. First, I have a quick story to share with you, so here it goes. Read More

This is the time of year everyone’s looking at how their investments performed. Don’t make the HUGE MISTAKE most other people make. First, I have a quick story to share with you, so here it goes. Read More

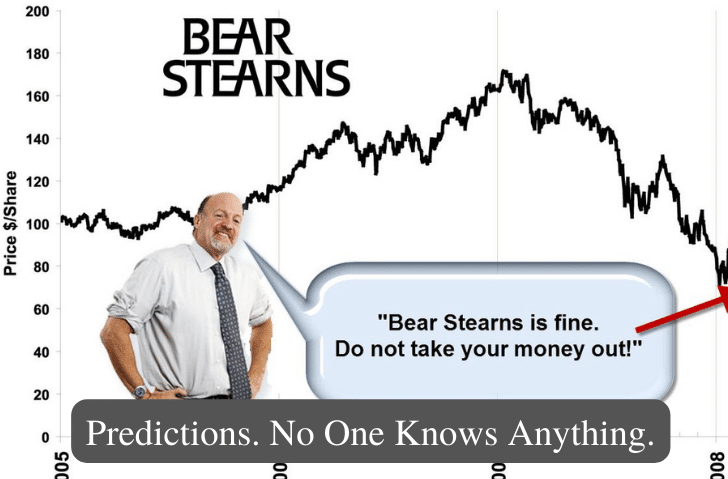

Welcome to the realm of finance, where the certitude of uncertainty reigns supreme. When it comes to predicting the stock market and economy, no one knows anything (with any real certainty). Let’s explore why. Read More

Environmental, Social, and Governance (ESG) investing has seen an unprecedented surge in recent years. While ESG factors should lead to more sustainable and responsible investments, there are concerns that the government push for ESG is distorting markets and negatively impacting retirees and their portfolios. In this blog post, we will discuss how government involvement in ESG investments create unintended consequences, and what retirees can do to protect their portfolios from volatility and maintain a reliable income stream. Read More

A brand new year is starting and if you learned anything from 2020, it’s that you need to be prepared for those “what-if” scenarios.

Having adequate emergency reserves is important and consider making it part of your 2021 saving goals. You should always strive to have at the very least six months’ worth of your monthly expenses set aside in your emergency reserves.

There are several options that you can choose from if you want to start saving money for emergencies. One of the best and easiest options is using a money market account.

A money market account is a type of interest-earning savings account, and is intended to offer investors high liquidity with a very low level of risk. They are also insured by the FDIC.

Are you trying to open a money market account? Let’s go through how and why to start using a money market account successfully. Read More

As baby boomers rush into retirement will they destroy the market? Read More

March Madness is here again and I want to take these 5 steps to investing and help you win your Bracketology. Read More

Elections are always crazy but this time around its definitely out of control. However, we have two candidates whose ideologies couldn’t be more different so how do you protect your portfolio and your retirement. Read More

Investors have a tendency to only want advice that makes them feel good. They want a quick fix. Here is the quick fix… Good advice never changes while markets and opportunities change daily. Stay focused on your plan and you will be successful long-term. Read More