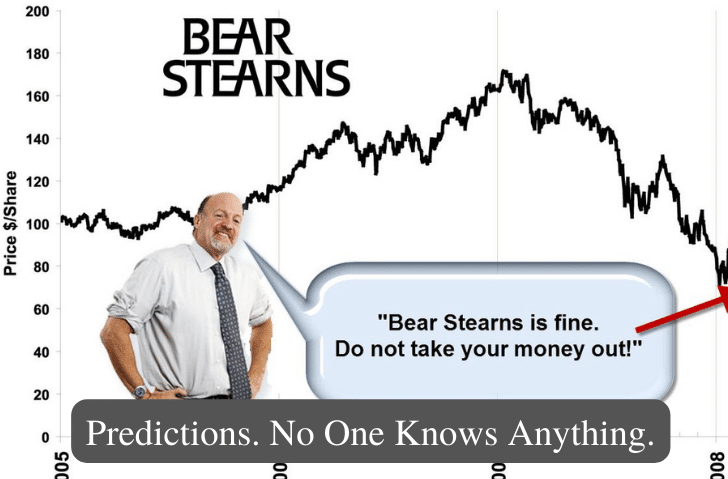

Welcome to the realm of finance, where the certitude of uncertainty reigns supreme. When it comes to predicting the stock market and economy, no one knows anything (with any real certainty). Let’s explore why.

The Stock Market

The stock market, a vibrant, unpredictable entity, is swayed by countless variables. Groundbreaking tech, surprise earnings reports, and geopolitical events can shift market dynamics in an instant. Analysts attempt to forecast trends using complex models and historical data. However, these predictions are educated guesses at best, unable to eliminate the inherent risks associated with investing.

The Economic Roller Coaster

Similarly, the economy is a dynamic puzzle. Government policies, interest rates, and the business climate dictate the ebbs and flows. Economists use indicators like GDP, employment rates, and CPI to predict trends, but the future remains elusive. Even with sophisticated tools, the economy often defies exact forecasting, reminding us of the relentless uncertainty of financial landscapes.

Strategy Amid All the Uncertainty

So, how do you navigate this unpredictable world? The answer lies in risk management and strategy. During your accumulation stage (working years), it’s crucial to diversify across multiple asset classes using low-cost indexed funds. This approach allows you to capture the entire market’s returns, at a lower costs and lower risk. Additionally, you should leverage the power of dollar-cost averaging, which involves investing a fixed amount in a particular investment at regular intervals. Regardless of the price, you keep investing. This strategy not only mitigates the impact of market volatility but also eliminates the pressure of timing the market, leading to a disciplined and potentially more successful investment strategy.

In the distribution stage (retirement years), since you can’t control the market and the economy, income guarantees become more important. Secure as many income guarantees as possible without solely relying on the stock market. Seek professional financial advice or conduct in-depth independent research before making significant financial decisions.

Long-term investment is typically more fruitful than attempting to ‘time’ the market. It’s about the time spent ‘in’ the market, not ‘timing’ the market that often brings substantial returns. And remember, only invest what you can afford to lose – a fundamental rule to live by in the financial world.

Embracing the Unknown

Predicting the stock market and economy is a fool’s errand. They are unpredictable entities that resist precise forecasting. Yet, this unpredictability should inspire a resilient strategy that can weather market volatility. It’s not about predicting every market move but preparing to adapt when those moves occur. In finance, navigating the unknown isn’t about perfect foresight but strategic preparation. In the end, the key to a good retirement plan is to have realistic expectations. Understand the limits of your portfolio and make sure to Contact me when planning for retirement.