A continuation on the importance of tax diversification. Totally tax free accounts offer great benefits dealing with the tax impact in retirement. Read More

A continuation on the importance of tax diversification. Totally tax free accounts offer great benefits dealing with the tax impact in retirement. Read More

A continuation on the importance of tax diversification. Tax Deferred accounts offer great benefits especially if your employer provides a match but be careful to properly plan the tax impact in retirement. Read More

When it comes to diversification, understanding the impact of taxes on your retirement is crucial to a successful and lasting plan. Read More

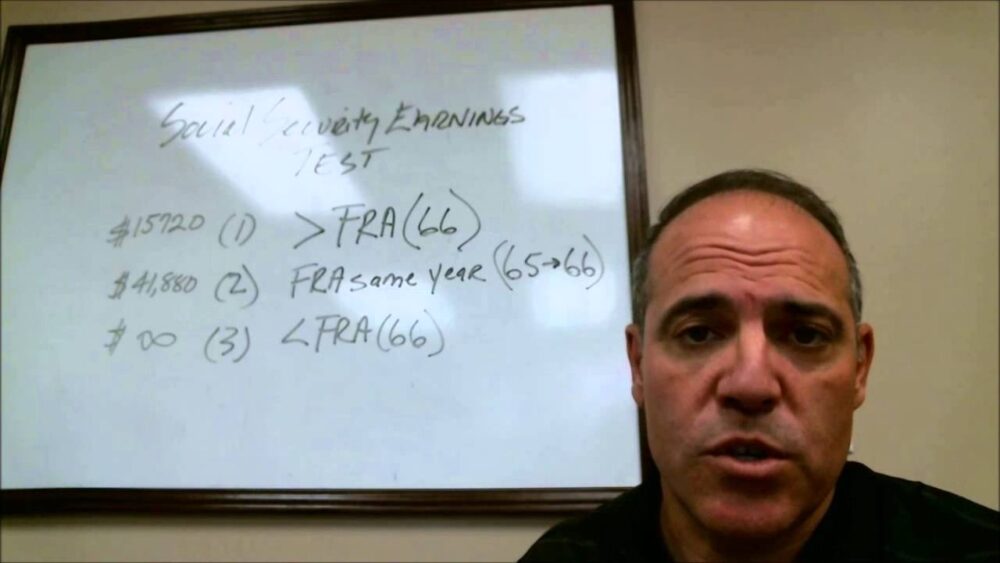

Can I work and collect Social Security at the same time? Well only if you follow these rules. Read More

You and your husband prepared to retire together then the unfortunate happens. Here are some points to be prepared about if your husband predeceases you. Read More

Far more money has been lost by investors, fund managers, and financial advisors preparing for corrections or anticipating corrections than has been lost in corrections. Read More

If you are retired you still run the risk of being audited by the IRS. Here are 4 common things that can raise a red flag. Be careful and let us help you with your tax preparation. Read More

Check out a recent letter received by Richard E. Reyes, CFP from a couple asking for help. Richard provides a detailed description of his clients. Read More

There will be over 250 million returns filed this year in the US. Do you think some will have mistakes? So what happens if you make a mistake on your tax return. Read More

What does Saturday and chocolate cake have to do with retirement? More than you think. So what are you going to do next? An important question to ask before you retire. Read More