Sometimes its hard to make up for lost time, however, you often have options. Here is a few things to consider if you haven’t saved enough or anything for retirement. Read More

Sometimes its hard to make up for lost time, however, you often have options. Here is a few things to consider if you haven’t saved enough or anything for retirement. Read More

Donald Trump has been elected as our new President. So what’s next for the market’s? Read More

Elections are always crazy but this time around its definitely out of control. However, we have two candidates whose ideologies couldn’t be more different so how do you protect your portfolio and your retirement. Read More

Getting remarried can lead to a host of financial complications. Here are some tips to to build a solid foundation. Read More

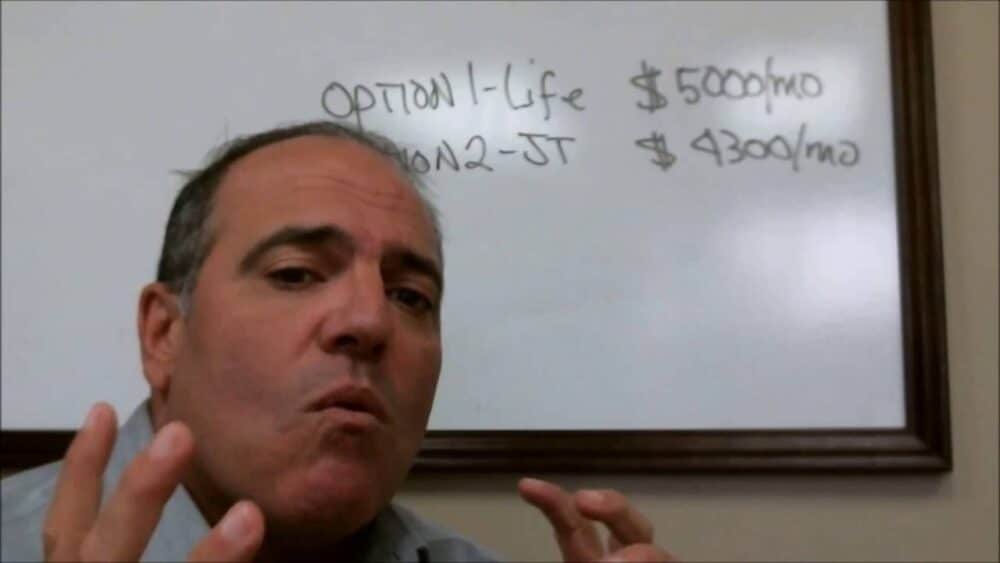

Do you need life insurance in retirement? Well here are 2 great uses for life insurance to take advantage of during your retirement. Read More

Do I need life insurance in retirement? Planning with life insurance can provide you with some safe and great benefits. Let’s review how life insurance can provide you with more pension income. Read More

In some cases you may be actually better off financially to have a spouse die than to go into a nursing home. Here is a case that I continue to see over and over again. Read More

There is a psychological perception that you must retire at the magic age of 65. Find out why that is not always the case or even the best plan. Read More

Investors have a tendency to only want advice that makes them feel good. They want a quick fix. Here is the quick fix… Good advice never changes while markets and opportunities change daily. Stay focused on your plan and you will be successful long-term. Read More

If you have a long-term care policy and have received a letter about an upcoming premium increase, here is what to do. Read More