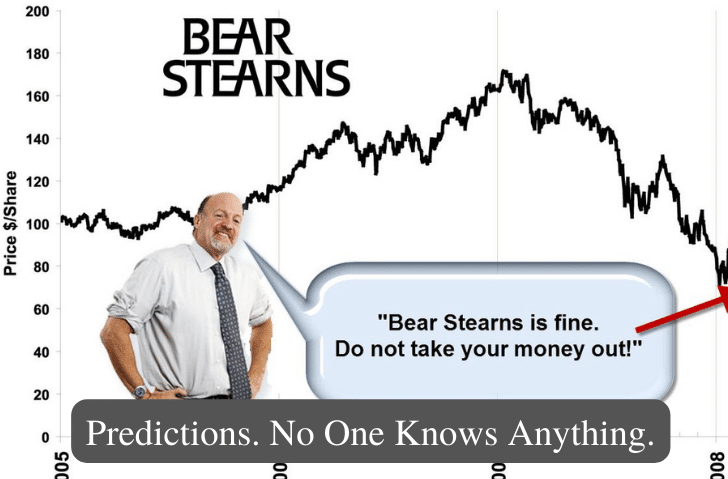

Welcome to the realm of finance, where the certitude of uncertainty reigns supreme. When it comes to predicting the stock market and economy, no one knows anything (with any real certainty). Let’s explore why. Read More

Welcome to the realm of finance, where the certitude of uncertainty reigns supreme. When it comes to predicting the stock market and economy, no one knows anything (with any real certainty). Let’s explore why. Read More

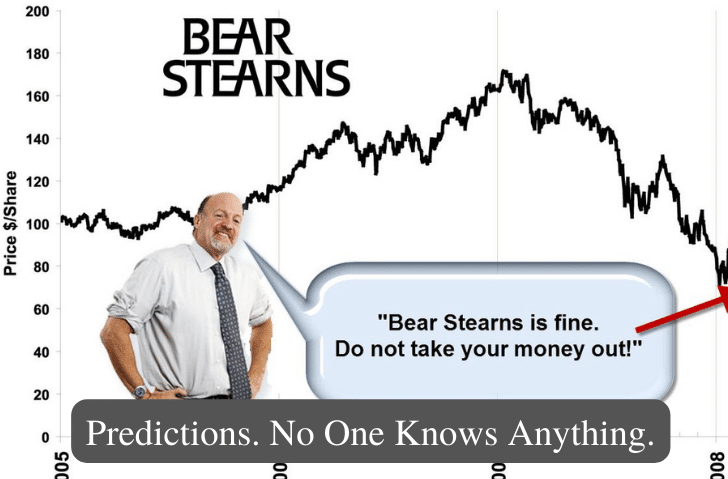

Finding yourself surprised by the rising costs of everyday purchases? You’re likely coming face-to-face with the economic phenomenon known as ‘sticky inflation’. Read More

Once upon a time, in the ever-fascinating world of finance, the siren call of complex charts and mind-boggling excel sheets beckon. Cloaked in a wizard’s robe, the financial planner appears with a twinkle in his eye, pulling you into the maze of retirement planning. They allure you with tales of turning your hard-earned $100,000 into a magical $1,000,000 retirement portfolio. And as mesmerizing as it sounds, I’m here to be your reality check. Don’t fret, the journey to the financial fountain of youth isn’t as arcane as it seems. So, buckle up as we deep dive into the wild world of retirement planning, debunking myths, and sprinkling reality checks along the way. Read More

Inflation is a complex economic phenomenon, often simplified as a general increase in the prices of goods and services over time. It is commonly believed that the Federal Reserve, or ‘the Fed’, has the tools to cure inflation. However, upon closer examination, one might discover that the methods used by the Fed to manage inflation can sometimes exacerbate the issue instead. Read More

Luck, they say, is when preparation meets opportunity. As much as we all want to believe that our successes in life and investing are purely the product of hard work and strategy, there’s an undeniable element of luck involved as well. Luck is an intriguing aspect of financial planning and how it plays into the grand scheme of our lives. Read More

In the world of retirement planning, one of the decisions that people often face is what to do with their employer-sponsored retirement plans when they leave their job. Whether you’re transitioning to a new employer or stepping into retirement, it’s crucial to make informed decisions about your retirement savings. One option that many individuals consider is rolling over their employer retirement plan into an Individual Retirement Account (IRA). Here, we delve into the reasons behind this popular choice. Read More

You’ve probably heard the phrase, “There’s no such thing as a free lunch,” but when it comes to tax-deferred retirement accounts, it might seem like the government is offering just that. A closer look, however, unveils an intriguing retirement strategy that benefits both parties: the individual saver and the government. It’s a tale of tax-time savings for you and eventual tax revenue for Uncle Sam. Read More

In the golden years of life, financial stability is paramount to maintaining your lifestyle and achieving true financial independence. Retirement planning plays a crucial role in securing this comfort, and the key to a successful retirement plan is a reliable, guaranteed income. While growth through investments such as the stock market is essential, they should not be the sole focus. Without a steady stream of income, retirement could be more of a challenge than a reward. Read More

The U.S. debt ceiling has been a hot topic of debate in recent years. Despite the serious overtones attached to this topic, is it possible that the hullabaloo surrounding the debt ceiling is more of a political maneuver rather than a genuine fiscal concern? Let’s delve into the history and the underlying constitutional provisions to find out. Read More

In today’s world, we are inundated with negative news at every turn. From political turmoil to natural disasters to economic uncertainty, it can be difficult to avoid the constant barrage of bad news. For investors, this can be especially challenging. In this blog post, we’ll discuss why living in a world of negative news is the greatest challenge for investors to overcome and what they can do to manage it. Read More