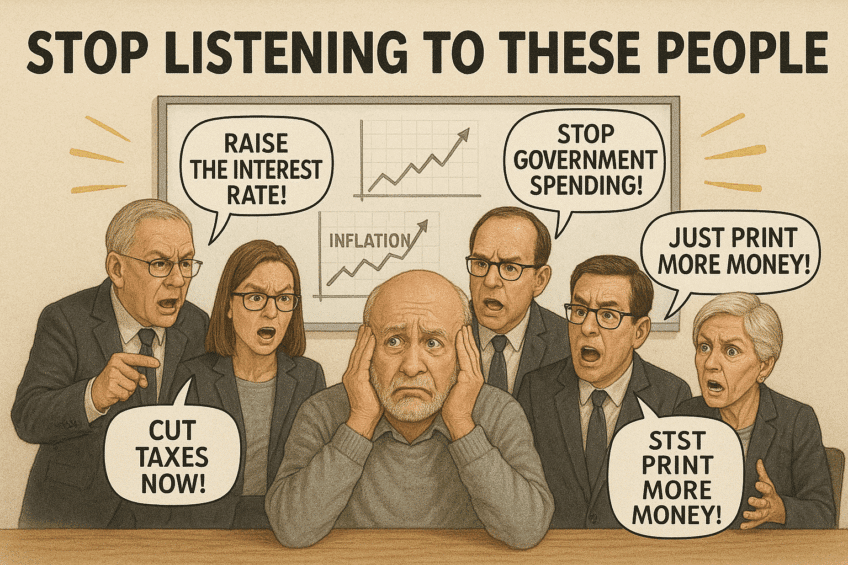

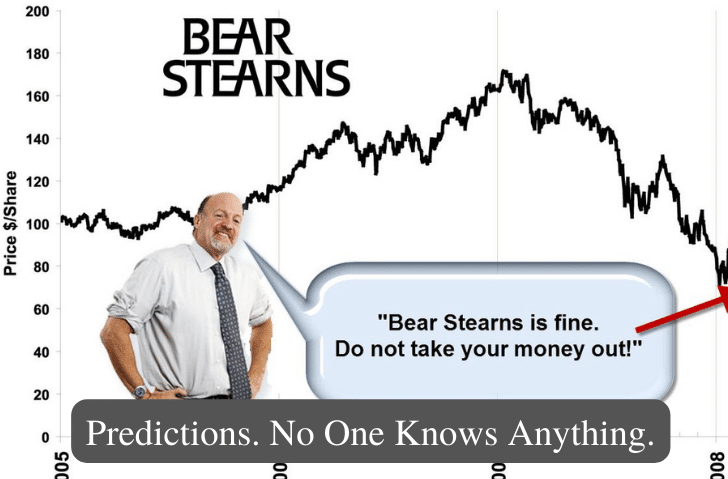

The stock market is a complex beast, often described as unpredictable in the short term. Why? Because it reflects the minute-by-minute decisions of roughly 7 billion people. If individuals struggle to predict their own actions an hour from now, how can anyone claim to forecast the collective behavior of billions with precision? The answer is simple: they can’t. Decades of market history show that no one—regardless of expertise—has consistent insight into short-term market movements. Read More