Once upon a time, in the ever-fascinating world of finance, the siren call of complex charts and mind-boggling excel sheets beckon. Cloaked in a wizard’s robe, the financial planner appears with a twinkle in his eye, pulling you into the maze of retirement planning. They allure you with tales of turning your hard-earned $100,000 into a magical $1,000,000 retirement portfolio. And as mesmerizing as it sounds, I’m here to be your reality check. Don’t fret, the journey to the financial fountain of youth isn’t as arcane as it seems. So, buckle up as we deep dive into the wild world of retirement planning, debunking myths, and sprinkling reality checks along the way.

The Tricky Tale of the $100,000 Portfolio

Imagine retiring with a $100,000 retirement portfolio. You’re brimming with excitement, dreaming of beaches and martinis, and then the bomb drops. You want a retirement income of $100,000 a year. Sorry to burst your bubble, but unless you find the proverbial pot of gold at the end of the rainbow or somehow persuade your dog to start laying golden eggs, it’s just not happening.

My friend, it’s as simple as the elementary math you dreaded in school. If you retire with $100,000 and spend $100,000 a year, well, your retirement fund will be as empty as a politician’s promise in less than a year! Oh, and if your financial planner swears they can turn that $100,000 into a million-dollar fortune, do check if they have a magical lamp with a wish-granting genie. Because, trust me, you’ll need it!

The Million-Dollar Mirage

Now, let’s take a moment to dream big. Let’s say you have a cool $1,000,000 saved for retirement. Swanky, right? You’re now dreaming of a $100,000 annual income in retirement, sipping pina coladas on the beach while watching the sunset. But, hold that thought! Time for another reality check.

Unless you’re immortal (and if you are, do let me know your secret!), drawing $100,000 a year from a $1,000,000 portfolio would deplete your funds in 10 years. That’s not including inflation, life’s curve balls, and your expensive golfing habit. So, unless you’re planning to retire at 85 and live till 95, or have a backup plan of robbing a bank in your eighties (which I strictly advise against), your retirement plan needs tweaking.

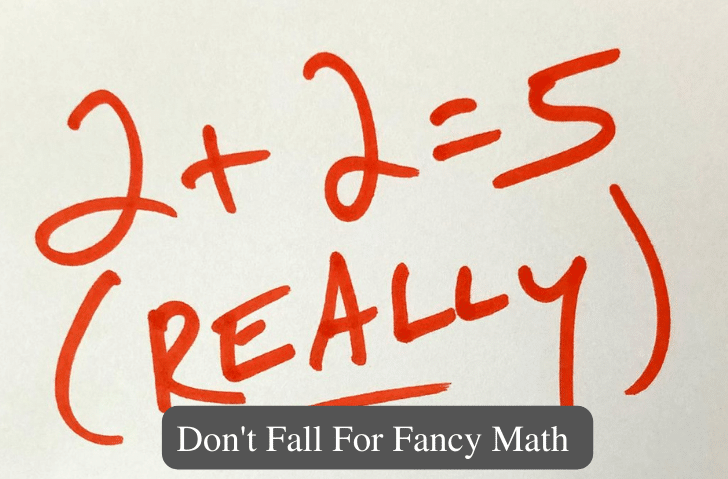

Let’s Get Real: It’s Just Simple Math

Don’t let your financial planner charm you into thinking that they have a secret algorithm or a magic wand that will defy the laws of mathematics. Retirement and financial planning boil down to simple arithmetic. You can’t spend more than you save. You can’t expect your $100,000 to suddenly bloom into $1,000,000. And you can’t deplete your million-dollar portfolio in a decade and expect to live the rest of your life in luxurious retirement.

Despite the charts, the spreadsheets, and the jargon that can make even Albert Einstein’s head spin, it’s really not rocket science. It’s all about saving smart, investing wisely, and living within your means. And the sooner you start, the better. Remember, compounding is the closest thing we have to magic in the financial world.

In the end, the key to a good retirement plan is to have realistic expectations. Understand the limits of your portfolio and make sure to Contact me when planning for retirement.