In our fast-paced world, where every moment counts and the future often feels like a distant horizon, there’s a common tendency to procrastinate on making important decisions. One such decision, often pushed aside, is the act of saving for your retirement. We all have our reasons, whether it’s the pressing demands of the present or a belief that tomorrow can wait. But hidden beneath this delay lies a significant, and sometimes surprising, cost that deserves our attention.

The Power of Compounding:

Let’s talk about compounding, which is like a magic trick for money. When you save, your money can grow not just on the initial amount you put away, but also on the interest it earns over time. Starting early is like planting a seed that grows into a big tree. Even small contributions can turn into significant savings because they have more time to grow.

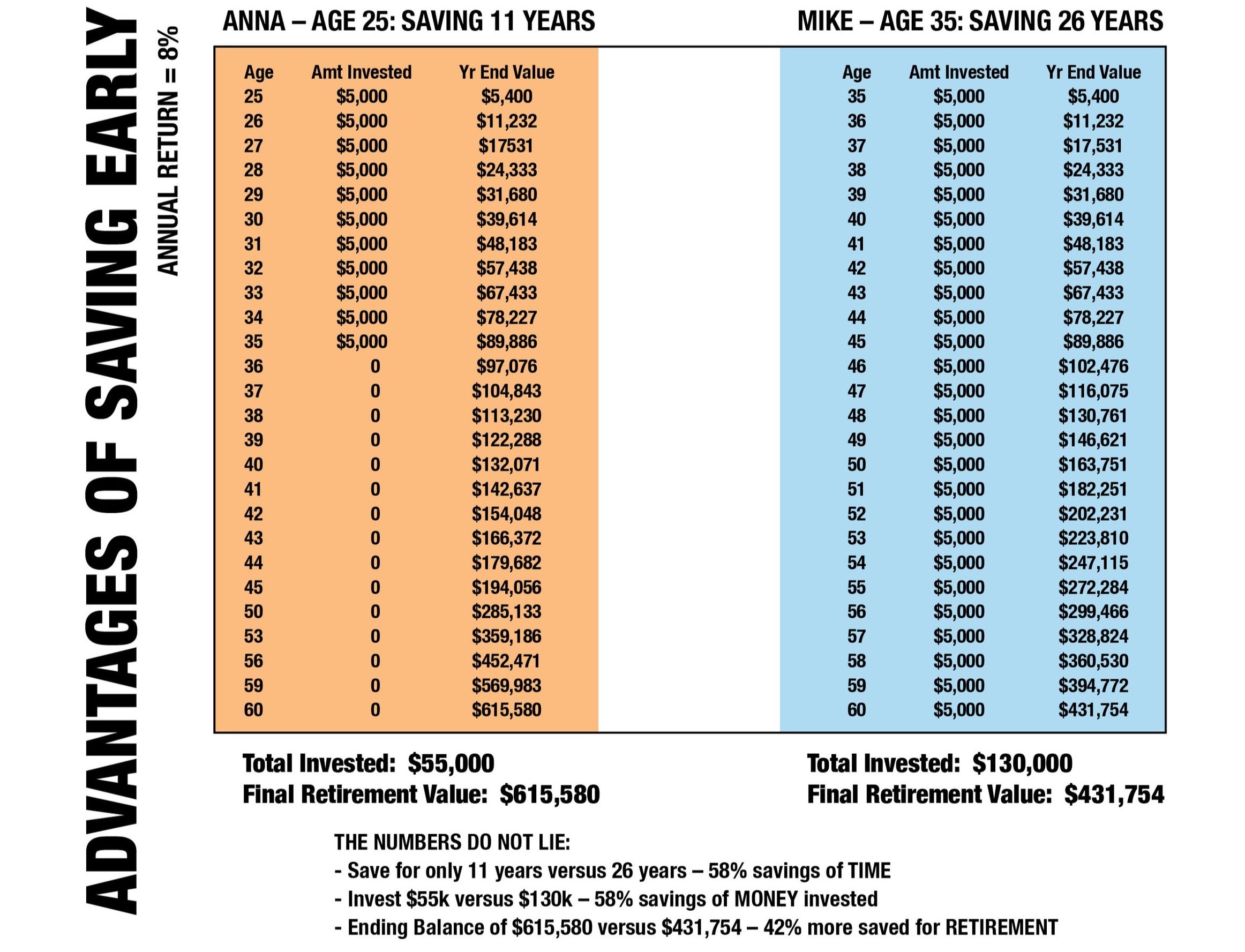

Imagine two friends: Anna and Mike.

Anna begins saving for retirement at 25, putting away $5,000 each year. Mike, on the other hand, starts at 35 putting away the same $5,000 annually. Assuming an average annual return of 8%, when they both reach 60, Anna’s investments would be around $615,580, while Mike would be approximately $431,754.

Despite Mike putting in the same amount of money each year, Anna ends up with a much bigger retirement fund because she had a ten-year head start.

Inflation: The Quiet Money Eater:

Inflation is like a silent thief that slowly takes away your purchasing power. It means that the same amount of money will buy less in the future. While it might not seem like a big deal right away, over many years, it can add up.

If you delay your retirement savings, you’re at risk of not keeping up with inflation. What seems like a comfortable amount of money now might not be enough to cover your needs in the future. Starting to save earlier helps protect your purchasing power during your retirement years.

Don’t Miss Employer Contributions:

Waiting to invest, especially in your Employer 401(k) means you will not only miss out on your employer match but also on the growth of those additional contributions over time.

Emotional and Mental Wellbeing:

Beyond the numbers, not saving for retirement can cause emotional and mental stress. As retirement age approaches, not having enough money saved can lead to anxiety and worry. Starting early and saving consistently can provide a sense of security and peace of mind, allowing you to enjoy your retirement without financial stress.

Remember, time is your best friend when it comes to retirement savings. Don’t let procrastination stand in the way of your future financial security. Start saving now, and you’ll be better prepared for a comfortable retirement.

How to Prevent Retirement-Planning Procrastination

While procrastinating to save is common, it is also avoidable. There are a few key things you can do to prevent procrastination in your retirement planning:

- Start small. Saving for retirement doesn’t have to be – and shouldn’t be – an all-or-nothing proposition. If you can only afford to save $500 per month, that’s okay! The important thing is that you start today and increase your savings as your income grows.

- Review finances whenever the opportunity arises. Starting a new job is an amazing time to revisit your retirement planning strategies. Allow that to be a celebratory process. After all, our eventual retirement is a huge reason we go to work each day!

- Get professional help. A financial advisor can offer guidance and support as you work towards your retirement goals.

The bottom line is this: don’t let procrastination get in the way of your retirement planning. Small steps today can translate into huge retirement strides in the future.

Stop waiting and start planning. Make sure to contact me.