Investing in the stock market is like a long adventure where you can earn money over time. But not everyone makes the same return on their money with their investments. Even if the whole market is doing really well, you might find your own money growing a bit slower. Here’s why your own investment return might be different from the big market return:

- Timing Is Everything: Imagine trying to jump onto a moving merry-go-round. If you jump on at just the right moment, you can have a great ride. But if your timing is off, you might not have as much fun. Investing is similar. Buying or selling stocks at the perfect time can be tricky, and if you don’t get it just right, you might not make as much money as the whole market does.

- Paying Fees: Think of fees like the small costs of playing a game. You might need to pay to get advice, buy or sell stocks, or have someone help manage your money. These fees can add up and take a chunk out of your earnings, making your personal return less than the market’s overall return.

- How You Spread Out Your Investments (Asset Allocation): This is like deciding how to spend your allowance. If you buy lots of different toys, games, or snacks, you spread out your spending. In investing, if you put your money into different types of investments (like stocks, bonds, or real estate), it affects how much money you can make. Not all investments grow at the same rate, so how you spread out your money can make your personal return different from the market’s return.

- Choosing What to Invest In: Just like choosing between a video game or a skateboard, where you put your money matters. Some investments might grow a lot, while others might not. Your choices, based on what you think is interesting or safe, can make your investment grow more or less than the market overall.

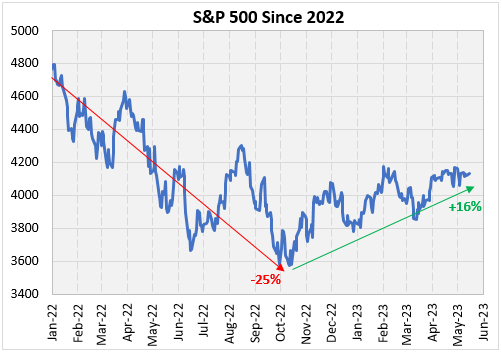

So, when you hear that the market is doing really well, remember that your own investments might grow a bit differently because of these reasons. It’s like a personal adventure where your choices, timing, and the fees you pay can change the outcome of your journey. Personal return and market return are important concepts in investment evaluation. When you’re looking at your returns, remember, you are not the market, you are likely not 100% invested in the market, you have not been invested as long as the market and progress is more important than perfection.