Clearly, lots of folks who are approaching their golden years are finding that they will be unable to maintain their standard of living once they retire. These people may have started saving too late; not saved enough; made bad investment choices; run into unexpected adversity; or probably experienced a combination of all of the above.

Here are a few strategies that, if taken seriously, might help you attain the retirement lifestyle you’re looking to achieve:

Save like crazy: It may seem a little obvious, but the most basic way to get back on track is to start saving — and do so much more significantly during the remainder of your working years than you have in the past.

Plan to work longer: Nobody wants to hear this, but it’s a fact that the number of years you work can make a big difference in your ability to properly fund retirement.

Work part-time in retirement: it can also provide you with enough leisure time that you won’t mind the few days that you do actually work.

Move somewhere with a lower cost of living: Northern high tax states or places like California or Washington are expensive. Maybe its time to move out. Also counties. Big cities are more expensive than rural counties. Review and see what fits you.

Downsize. Hopefully you have built enough equity to make a difference.

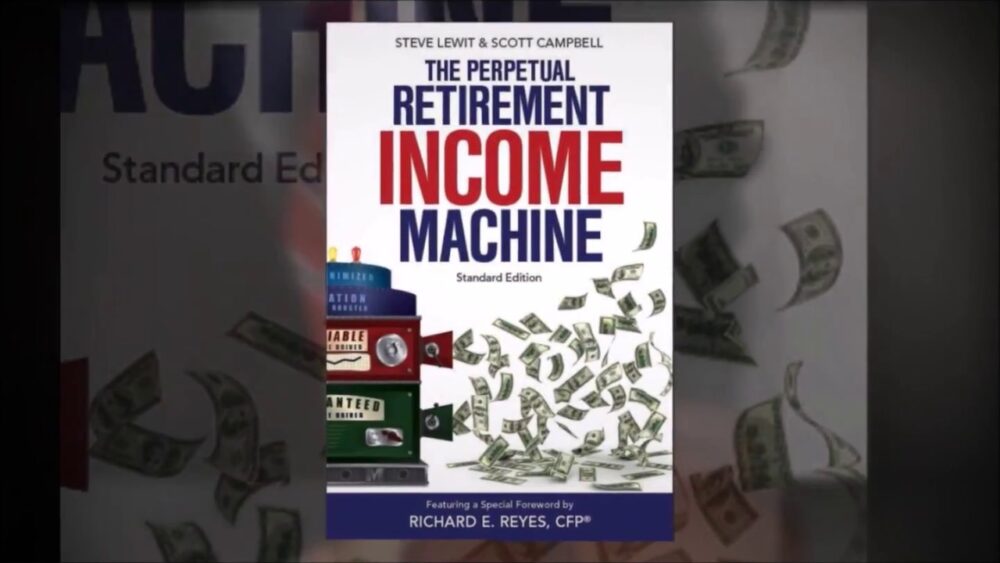

Make sure your investments are properly managed. There is great risk at retirement in being either too aggressive or to conservative and make sure you have a perpetual retirement income machine to go along with your income plan.

It only gets harder if you don’t take action now.