The stock market is a complex beast, often described as unpredictable in the short term. Why? Because it reflects the minute-by-minute decisions of roughly 7 billion people. If individuals struggle to predict their own actions an hour from now, how can anyone claim to forecast the collective behavior of billions with precision? The answer is simple: they can’t. Decades of market history show that no one—regardless of expertise—has consistent insight into short-term market movements.

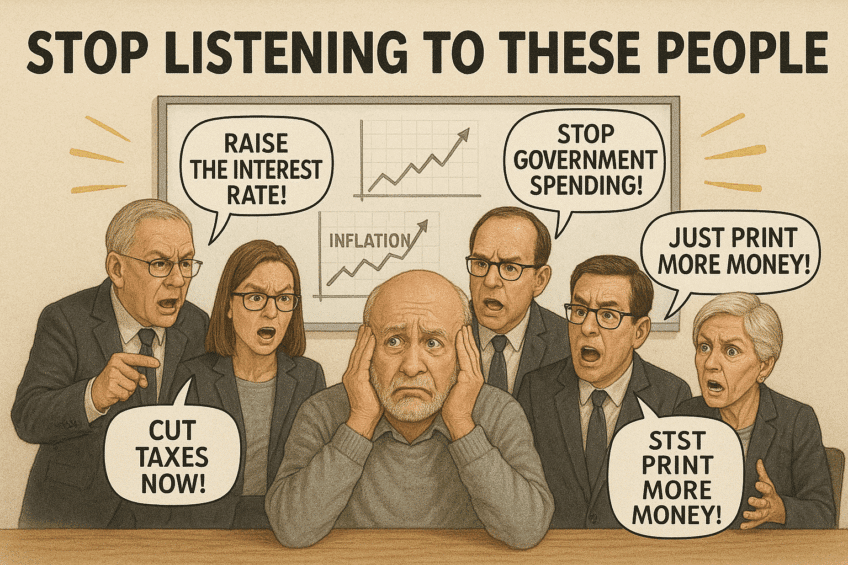

Warren Buffett, the Oracle of Omaha, has famously dismissed the predictive power of economists. “I don’t pay any attention to what economists say, frankly,” Buffett remarked. He pointed out that even brilliant economists with “160 IQs” rarely amass wealth through stock trading. Buffett cited John Maynard Keynes, a renowned economist who suffered heavy losses in the 1920s and 1930s speculating on currencies and stocks using top-down economic forecasts like credit cycle predictions. It was only when Keynes shifted to a value-driven approach—focusing on owning shares in well-run companies for the long term—that his investment success improved.

This unpredictability, however, is not a flaw—it’s the engine of returns. Uncertainty in the stock market is synonymous with risk, and risk is what drives investment returns. The higher the uncertainty, the higher the potential reward, as investors demand greater compensation for taking on more risk. Conversely, investments with lower uncertainty, like government bonds, offer lower returns due to their relative safety. It’s a straightforward principle: no risk, no reward. Importantly, no investment is entirely free of uncertainty. Even the “safest” assets carry some degree of risk.

Buffett’s skepticism of economists underscores a key lesson: short-term market predictions often lead to disappointment. “If you look at the whole history of [economists], they don’t make a lot of money buying and selling stocks,” he noted, questioning why investors heed their forecasts. Instead, a disciplined, long-term approach—rooted in understanding a company’s fundamentals—tends to outperform speculative bets on market swings.

For investors, the takeaway is clear: embrace the stock market’s uncertainty. It’s not something to fear but a fundamental feature that creates opportunities for returns. By focusing on long-term value rather than chasing short-term predictions, you align with the principles that have guided investors like Buffett to success. Risk is the price of opportunity—accept it, manage it, and let it work in your favor over time.